Is green finance for women sufficient, particularly in Africa? The committed women and feminist and environmental organisations consulted by Afrik 21 all agree that it isn't, and have come up with solutions to accelerate sustainable financing to drive environmental changeOn the occasion of International Women's Rights Day, which is being celebrated on 8 March 2024, we have compiled their proposals in this article.

Women may be more vulnerable to climate change, but they also have the ideas and leadership needed to effectively combat this phenomenon, which is now upsetting the balance of the ecosystem, with record-breaking heat south of the Sahara, melting Arctic ice and devastating floods along the Mediterranean coast.

We are therefore seeing more and more women working to promote sustainable development, particularly on the African continent, which is warming faster than the global average (with a temperature increase of + 1.4°C since the pre-industrial era compared with + 1.1°C on a global scale, editor’s note). The Malagasy researcher Lovasoa Rina Raharinaivo, whose work focuses on “pollution and its alternatives in Madagascar”, the Rwandan Ange Cynthia Umuhire, who is working on “predicting and forecasting space weather in Rwanda”, and the young Iveren Abiem, who has developed the “carbon sequestration in the Afromontane forest” project in Nigeria, researcher Farida Boube Dobi for her initiative on the management of sovereign waters in Niger, and Mawulolo Yomo from Togo, a doctoral student specialising in life and environmental sciences, who stands out for her work on “the dynamics of seawater intrusion in Togo’s coastal sedimentary basin”.

Read Also – AFRICA: between climate hazards and ecological solutions, women at the heart of SDGs

The ideas of these scientists have also been awarded the “Young talents in sub-Saharan Africa for women and science” prize by the United Nations Educational, Scientific and Cultural Organisation (UNESCO) and the L’Oréal foundation of the French industrial group specialising in cosmetics, in 2022. We can also mention iron ladies such as Arlette Soudan Nonault, the Congolese Minister for the Environment, Sustainable Development and the Congo Basin, and Wangari Muta Maathai, a role model for the ecological struggle in Africa, who are campaigning to reconcile mitigation and development in Africa.

But can ideas alone be enough without financial support? This is the question that will be raised during the many debates organised on 8 March to mark International Women’s Rights Day. Strategies for accelerating green finance for women will also be discussed, in relation to this year’s theme: “Investing in women, accelerating the pace”.

How can green finance for women be accelerated?

The United Nations Environment Programme (UNEP) explains the shortfall in climate financing for women by the fact that the adaptation financing needs of developing countries as a whole are 10 to 18 times greater than international public funding flows. Fundraising by African start-ups fell by 36% in 2023 to 3.2 billion dollars, compared with 5 billion in 2022, according to data published on Wednesday 3 January 2024 by the digital economy consultancy TechCabal Insights.

The United Nations is therefore advocating the transfer of funds, the increase and adaptation of financing for small and medium-sized enterprises (SMEs), the implementation of Article 2.1(c) of the Paris Agreement on the redirection of financial flows towards low-carbon and climate-resilient development paths, and a reform of the global financial architecture to reduce the financing gap.

For the global Rights and Resources coalition, donors must make a conscious effort to disseminate information about funding opportunities for women and girls; adapt funding using bottom-up and context-based approaches to gender-responsive climate finance, and create monitoring frameworks for climate adaptation, resilience and mitigation informed by women’s experiences in accessing and managing these funds; and ensure women’s representation on internal committees formed by donors to allocate and monitor committed funds, among others.

With 24% of African women entrepreneurs, they far outnumber their European counterparts. Despite this, they still face considerable obstacles, laments Kadia Sylla Moison, who points out that in terms of funding, they remain under-financed and very often have limited access to venture capital financing. “I think it is important to provide tailored and specific support to enable women’s contributions to the African economy to be fully integrated, particularly those working to combat climate change, of which they are the first victims. We also need to create public-private partnerships with microfinance companies to facilitate access to credit and encourage vocational training and financial education”, adds this entrepreneur committed to Africa, and director of the Grant Alexander human resources consulting and services group.

Some concrete initiatives to promote women’s access to capital

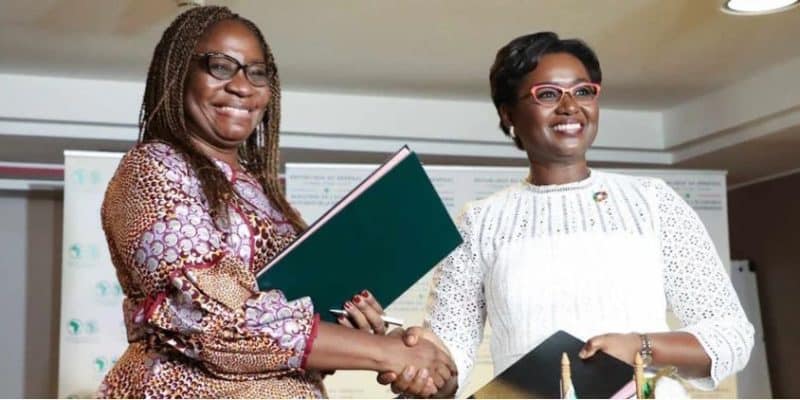

Nevertheless, real progress is being made, thanks in particular to initiatives such as the Affirmative Action for Women in Africa (AFAWA), which aims to close the financing gap affecting women in Africa, estimated at 42 billion dollars. AFAWA relies on the various financial instruments of the African Development Bank (AfDB). In 2018, they granted more than $50 million in credit lines to women via institutions such as Fidelity Bank and Kenya Commercial Bank.

Read Also – AFRICA: gender equality in financing, a condition for speeding progress towards MDGs

AFAWA is also an anchor investor in Alitheia IDF Managers (AIM), the first private equity fund of its kind, led by experienced women fund managers and investing in high-growth women-owned and women-led small and medium-sized enterprises (SMEs) in Africa. AIM, which is targeting ten countries in Southern and West Africa, aims to raise $100 million.

“We should also mention the commitment of microfinance companies such as the private financial services group Finadev and the Akiba Finance group in Guinea to supporting women and providing funding for various income-generating activities”, adds Kadia Sylla Moison, who is also the founding president of the Audacity for Africa association, which works to provide vocational training for young people, particularly African women, in entrepreneurial projects.

Inès Magoum