The world today faces a number of vulnerabilities. They range from climate change, which manifests itself in drought, floods, cyclones, hurricanes and typhoons, to the Covid-19 pandemic and wars, including the one that has been raging between Russia and Ukraine since 2022. Innovative sources of funding are therefore becoming necessary to meet ever-growing needs. The Summit for a "New Global Financial Deal", which came to a close on 23 June 2023 in Paris, France, enabled leaders from around the world to suggest innovations in terms of instruments and financing, including reducing the interest rate on debt, increasing the paid-in capital of banks and reforming the system of financial institutions.

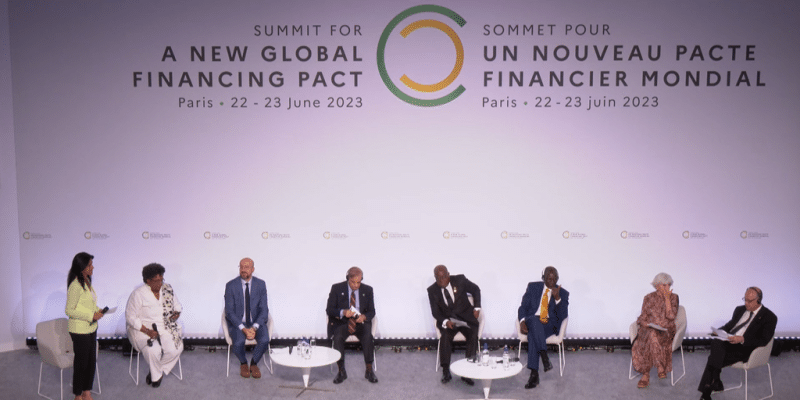

Over the next few years, the global financial architecture will have to be gradually transformed. This will require new approaches, new instruments and new resources. The round table on “Innovative instruments and financing to address the challenges of vulnerability”, held on 22 June 2023 at the Palais de Brongniart in Paris, France, as part of the Summit for a “New Global Financial Deal” organised by Emmanuel Macron, was an opportunity for African, European and Asian leaders to reiterate this, but also to put forward proposals that should lead to the establishment of a universal financing mechanism.

They were William Ruto, President of the Republic of Kenya, Nana Akufo-Addo, President of the Republic of Ghana, Charles Michel, President of the European Council, Laurence Tubiana, President and Executive Director of the European Climate Foundation (ECF), and Ilan Goldfajn, President of the Inter-American Development Bank (IDB). They were joined by moderators Chrysoula Zacharopoulou, French Secretary of State for Development, Francophonie and International Partnerships, and Mia Amor Mottley, Prime Minister of Barbados, who opened the floor to proposals.

More funding to manage growing needs

The first step will be to increase the paid-in capital in the banks, said Mia Amor Mottley. This additional capital could be used to manage growing needs, particularly in developing countries, especially in areas that do not generate sources of income on their own, such as responding to loss and damage in the face of various vulnerabilities such as drought, floods, the Covid-19 pandemic or the war in Ukraine. “We will choose a mechanism to manage these common assets. It could be the World Bank or another mechanism, and at that point we will have to overcome the problems of geopolitics and national politics”, added Mia Amor Mottley.

Read Also – Drought, food crisis… Time for action, says Mohamed Bazoum

Reducing the interest rate on debt worldwide, or even abolishing it altogether in the most vulnerable countries, are also serious avenues that could be explored according to the Prime Minister of Barbados, albeit a controversial one”. The Maastricht Treaty refers to a rate of 60% that the Monetary Fund and the World Bank apply. This rate was set for a world that was not facing these multiple crises. If we ask countries to continue on this 60% trajectory, it will quite simply kill off their ability to develop”.

Reforming the system of financial institutions and policies

And Africa is the continent most affected by this percentage. For African leaders, there is also an urgent need to reform the system of financial institutions, which is no longer appropriate. “We pay eight times what other countries pay because of this system. The chances that we will end up in debt are therefore eight times greater”, said the President of the Republic of Kenya, William Ruto, indignantly at the Paris round table on innovative instruments and financing to address the challenges of vulnerability.

For the Kenyan leader, a grace period of 15 or 20 years would solve many of the problems. “We would repay our debt, which has been deferred, shareholders would be satisfied and we would have immediate money to solve immediate problems”. Next, the multilateral development banks will have to be completely transformed to accelerate development and be able to repay these debts.

The most polluting industries must contribute to action

According to Kenyan President William Ruto, it would take 9.2 billion dollars each year to achieve carbon neutrality by 2050, as projected in the 2015 Paris Accords, and this funding is 3.5 billion dollars short. This is three times the amount of Zambia’s external debt, which was recently halved as a result of its “cascading” default on payments to China and its other creditors. The urgent mobilisation of this liquidity will also require the introduction of new tax regimes and contributions levied on the profits of globalisation in accordance with the polluter-pays principle. “By introducing a system of taxation on freight transport, which is one of the major causes of environmental degradation, we could earn 1 billion dollars a year, for example”, said Laurence Tubiana, President and Executive Director of the European Climate Foundation (ECF). Carbon pricing is an approach that she believes could be extended to several other sectors, such as aviation and energy, and to which the President of the European Council, Charles Michel, also referred.

Read Also – AFRICA: in Paris, 4 heads of state plead for faster green growth

Achieving a win-win situation. In the end, this is what leaders around the world want, especially in Africa,” summed up Chrysoula Zacharopoulou, France’s Secretary of State for Foreign Affairs. And Africa wants to be involved. So, in addition to innovation in instruments and financing, the President of the Republic of Ghana, Nana Akufo-Addo, suggested acting creatively and forging new approaches to development. An approach that calls for reasonable and respectful cooperation between developed and developing countries.

Inès Magoum