As the solar energy market attracts more and more investors in sub-Saharan Africa, the Norwegian Investment Fund for Developing Countries (NORFUND) has announced the sale of its shares in solar power plants in two countries. In Mozambique, NORFUND is selling its stake in the 40 MWp Macuba solar photovoltaic plant to Globeleq, an independent power producer (IPP) in which it has a 30% stake along with British International Investment (BII).

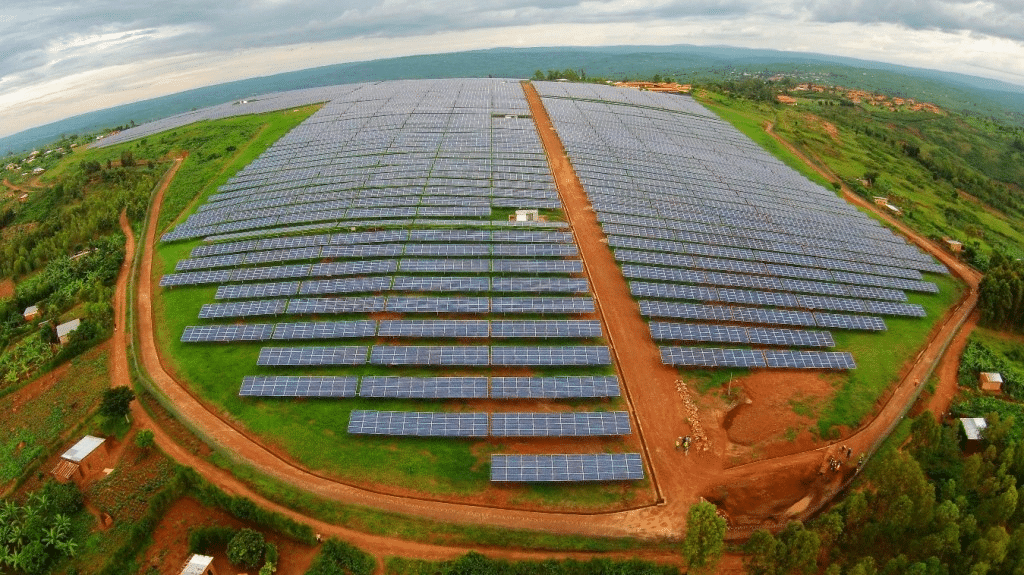

In Rwanda, NORFUND took part in the construction of the country’s first photovoltaic solar power plant, in the Rubona district. The plant, which has been connected to the Rwanda Energy Group (REG) grid since 2015, has a capacity of 8.5 MWp. NORFUND’s stake in this energy infrastructure, which will remain under contract for a further 16 years, has been sold to the US company Fortis Green Fund I, Rwanda Holdings and Axian Energy of Madagascar.

Read also- KENYA: US company BlackRock invests in 310 MW Lake Turkana wind farm

For Mark Davis, NORFUND’s Vice President in charge of renewable energy, the sale of these assets “frees up capital that we will reinvest where it can have the greatest impact in terms of fighting poverty and reducing emissions”. The investment company has also sold its stake in the 310 MW Lake Turkana wind farm in Kenya.

At the same time, NORFUND is continuing to invest in other renewable energy segments, notably decentralised solar systems for rural electrification. The Norwegian investor, for example, is a shareholder in WeLight with the Madagascan group Axian and the French company Sogemcom. In rural areas of Madagascar and Mali, the company is installing small electricity networks powered by photovoltaic solar energy.

Jean Marie Takouleu