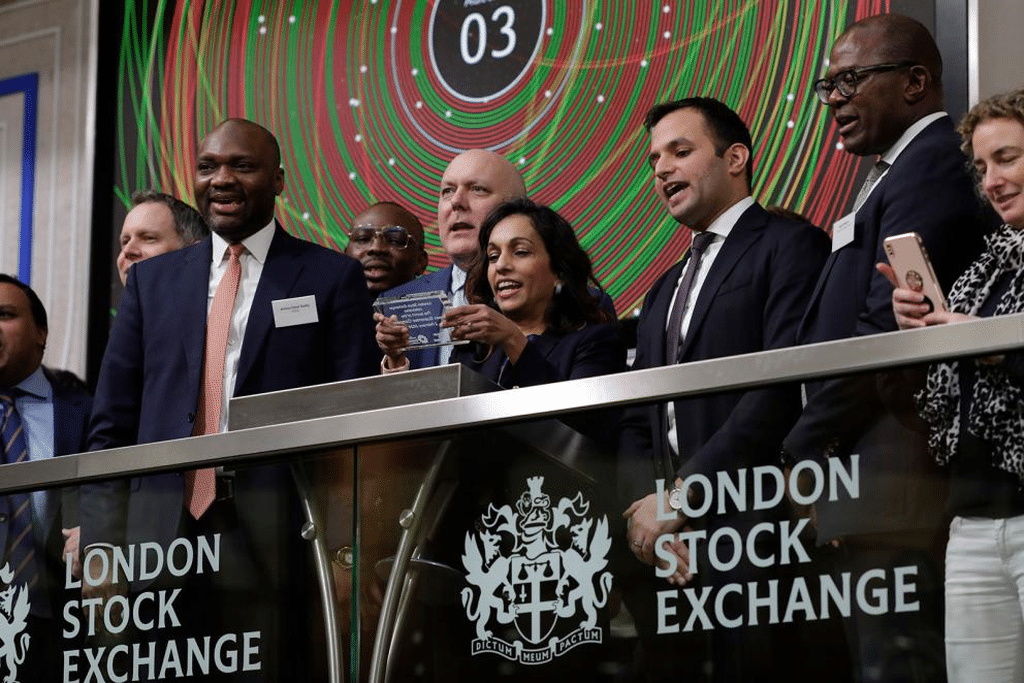

A new financial mechanism has been launched to catalyze climate finance worldwide. The Green Guarantee Company (GGC) was recently launched on the London Stock Exchange (LSE). It is an initiative of the Development Guarantee Group, which was co-founded with Dutch investment company Cardano Development. The LSE-listed company aims to secure $5 billion in climate finance in developing countries by 2035.

To achieve this, GGC is counting on the contribution of several development partners active in the South. These include the UK’s Foreign Commonwealth & Development Office (FCDO) through its Mobilist program, the Green Climate Fund (GCF), the Nigeria Sovereign Investment Authority (NSIA), the United States Agency for International Development (Usaid) through its Prosper Africa initiative, and Norfund.

The first beneficiary countries in Africa

Initially, these development finance institutions will inject $100 million into the new guarantee company. The GGC will initially focus on private credit and the LSE’s green bond market, but plans to expand to other major stock exchanges. It will seek to raise additional capital from the private sector as it develops its operations,” says the GCF.

Read also- Climate finance: London guarantees $239 million from the AfDB for Benin and Mauritius

The company will guarantee investments in infrastructure, notably in the renewable (and alternative) energy sectors, sustainable transport, etc. The first guarantees will be granted “as a priority to issuers in countries eligible for official development assistance in Africa, Asia and Latin America”, announces the GCF. These countries include Kenya and Egypt in Africa, India, Indonesia, Vietnam and the Philippines in Asia, and Brazil in Latin America.

As part of its mission, GGC will help “borrowers provide quality reporting on the climate impact of the green bonds and loans it guarantees”, says the GCF. The new company will work with issuers to “strengthen their ability to provide quality and consistent reporting to help make green bonds and loans from developing countries an attractive asset class deserving of larger allocations in global climate debt portfolios”, says the Green Climate Fund.

Jean Marie Takouleu